- Զամբյուղը դատարկ է

- Շարունակել առևտուրը

Understanding Forex Trading Options A Comprehensive Guide 1834917907

Understanding Forex Trading Options: A Comprehensive Guide

In the fast-paced world of financial markets, Forex trading options have become increasingly popular among traders seeking flexibility and potential profitability. These options allow traders to speculate on currency pairs without the need to own the underlying currency. As we delve into the realm of Forex trading options, it’s essential to grasp how they function, the benefits they provide, and the strategies traders employ. Moreover, if you’re looking to start trading in regions like Qatar, you may want to check out forex trading options Trading Brokers in Qatar to find suitable platforms and brokers.

What are Forex Trading Options?

Forex trading options are derivative contracts that give traders the right, but not the obligation, to buy or sell a currency pair at a predetermined price within a specific time frame. This unique feature allows traders to hedge their positions or speculate on market movements without committing to a full trade immediately. In essence, a Forex option can be thought of as an insurance policy, providing traders with the ability to protect their investments against unfavorable market conditions.

Types of Forex Options

There are two primary types of Forex options:

- Call Options: These give the holder the right to purchase a currency pair at a specified strike price before the option expires. Traders buy call options when they anticipate that the currency value will rise.

- Put Options: Conversely, these options provide the right to sell a currency pair at a designated strike price. Traders buy put options when they predict that the currency value will decline.

How Forex Options Work

When you purchase a Forex option, you pay a premium, which is the price of the option contract. This premium gives you the right to exercise the option at any point before expiration. If the currency pair moves in the desired direction, you can exercise your option and make a profit, or you can sell the option to another trader. If, however, the market moves against you, you can choose not to exercise the option, and your loss is limited to the premium paid.

Let’s consider an example. Suppose you purchase a call option for EUR/USD with a strike price of 1.2000 and a premium of 0.0050, expiring in one month. If, within that month, the EUR/USD rises to 1.2500, you can exercise your option and buy the euro at 1.2000, then sell it at the market price of 1.2500, realizing a profit of 0.0500 per unit. Alternatively, if the market price remains below 1.2000, you can choose not to exercise your option, and your loss is limited to the premium of 0.0050.

Advantages of Forex Trading Options

Forex trading options come with several notable advantages:

- Risk Management: Options allow traders to hedge their positions, minimizing potential losses during adverse market movements.

- Flexibility: Traders can choose from various strategies, including spreads and straddles, to suit their market outlook and risk tolerance.

- Leverage: Forex options generally require a smaller capital investment compared to direct trading of currency pairs, enabling traders to leverage their positions effectively.

- Defined Maximum Loss: The maximum loss is limited to the premium paid, providing a clear risk assessment for traders.

Forex Options Trading Strategies

Various strategies can be employed when trading Forex options, allowing traders to adapt to different market conditions:

- Hedging: Traders can use options to protect an existing position from adverse movements by purchasing put options as insurance.

- Speculation: Some traders simply buy options to speculate on market movements, aiming for profit when the market moves favorably.

- Straddles and Strangles: These strategies involve buying both call and put options at different strike prices or the same strike price to capitalize on high volatility in the underlying market.

- Spreads: This strategy involves buying one option and selling another simultaneously, allowing traders to limit their risk while maximizing potential returns.

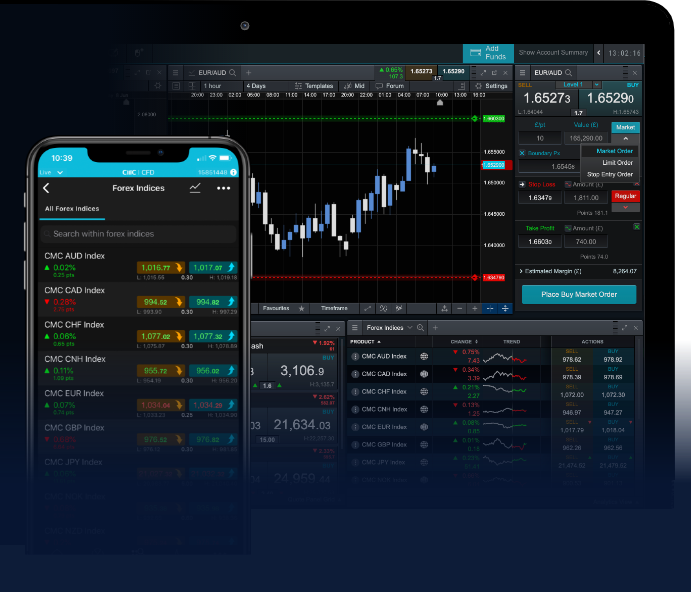

Choosing the Right Forex Trading Platform

Selecting the appropriate Forex trading platform is a crucial step towards trading success. Here are some factors to consider:

- Regulation: Ensure that the broker you choose is regulated by a recognized authority to protect your investments.

- Trading Tools: Look for platforms that offer comprehensive trading tools, including analysis tools, charting software, and educational resources.

- Fees and Spreads: Compare the fees and spreads across different brokers to ensure you’re getting a competitive rate.

- Customer Support: Good customer support can make a significant difference, especially for new traders who may require assistance.

Conclusion

Forex trading options present an exciting opportunity for traders looking to navigate the foreign exchange market with flexibility and reduced risk. By understanding how options work and employing strategic trading approaches, traders can enhance their potential for success while managing their exposure to market volatility. If you’re considering entering this dynamic market, ensure you conduct thorough research and choose a reputable broker to start your Forex trading journey. With the right knowledge and approach, Forex options can be an integral part of your trading success.