- Զամբյուղը դատարկ է

- Շարունակել առևտուրը

The new six better playing cards for spending your play online blackjack own smartphone expenses

Blogs

On the cellular phone defense advantageous asset of the brand new Delta SkyMiles Precious metal American Show Cards, qualification and you can work for peak may vary by the credit. Wells Fargo Rewards are good thanks to the versatile redemption alternatives they give. As well, for individuals who never get rid of otherwise ruin their cell phone, you might be better off acquiring far more credit card perks and you may giving up cellular telephone insurance policies. All of our experienced and you can experienced party will bring numerous years of experience with the fresh bank card and traveling groups. Committed to ethics, we provide analysis-determined courses to discover the cards(s) you to best suit your criteria. Find home elevators the rigorous editorial principles and you can cards score methodologies.

After that, what you need to do in order to build payments is hold-down possibly the back otherwise house key on your own check out, according to the design. Their handmade cards will appear, and also you’ll manage to proceed with the cellular fee. Inside a situation study we presented inside the Portland, Oregon, NFC costs boost tipping prices. Customers whom used the cell phones or NFC gizmos to expend was more likely to tip than just users who put old-fashioned magstripe cards. Below are a few other ways recognizing cellular money helps organizations. Fruit Spend runs on the iphone 3gs, type 6 otherwise later, and also the Apple Observe.

ideas to help you create to your-time money: play online blackjack

Not all the vending computers otherwise gasoline pumps was play online blackjack appropriate for mobile shell out. Zero, which have a balance of no for the a charge card isn’t harmful to their credit. But when you’re staying away from the credit card account after all, you might come across potential cons such spending so many yearly costs or having your membership signed on account of laziness. Having fun with credit cards to pay your own mobile phone bill are a terrific way to secure advantages and take advantageous asset of almost every other card advantages. For starters, should your bank card organization grabs on the, they could option your business card to help you a personal account. Then you certainly eliminate your chance to earn finest benefits to the team orders.

Overview of a knowledgeable notes to own paying the mobile phone costs

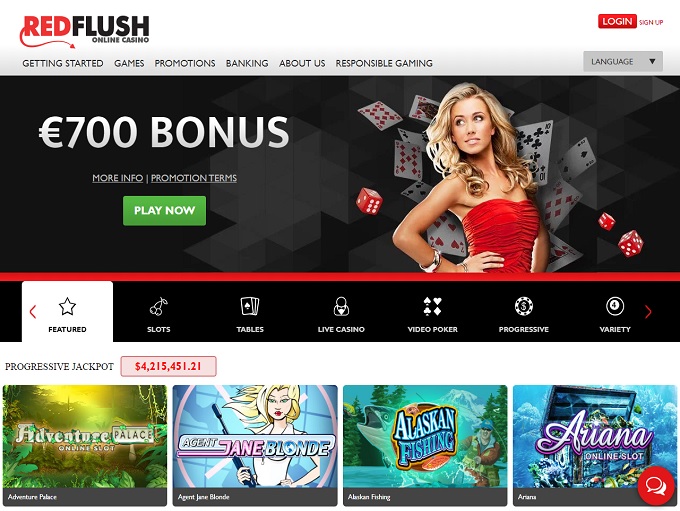

Bank’s travel portal simply offers added bonus things for the prepaid service lodging and you can rental automobiles although not any other type out of travelling bookings. Utilizing your credit to expend individually that have a flight, although not, create earn 3x issues on the credit’s wide “travel” class. It’s as well as easier and offers increased sureity against people cloning your own charge card matter. Spend because of the mobile phone slots refer to on the internet slot game that are offered at shell out because of the cellular phone gambling enterprise websites. There are no real independent slots to own spend by mobile and other financial procedures. This is especially important which have shell out from the cellular telephone services as they is actually credit-dependent, emphasising the necessity of in charge gaming habits.

Your obtained’t must open the newest application and you also’ll know your payment was successful once you see a bluish checkmark to your screen. The lending company you to provided your own Visa borrowing otherwise debit card should be using to provide they so you can a cost-let cellular phone or tool. You have access to a great 0% equilibrium transfer Apr promotion, and this can be rewarding if you wish to stop attention costs and you will accrual off their handmade cards. Following 0% several months, typical Apr, as stated a lot more than, can be applied. Thus cardholders of one’s Twice Cash card often today secure 2% on every buy with limitless step one% money back once you pick, as well as a supplementary step one% as you buy those requests. Contactless money are created without having to keep a mobile device alongside a fees critical.

- Enroll on the internet to create payment reminders, access your own 100 percent free FICO score online, comment purchases, and sustain monitoring of all membership from anywhere, for the one device.

- Publish money from a bank account or make use of borrowing from the bank otherwise debit card2.

- MyBankTracker and you may CardRatings can get found a percentage away from credit card providers.

- They uses tokenization (substitution their card amount having another code), so your cards amount is not in fact carried inside the payment.

Just discover their mobile bag, prefer their debit credit and you will tap they during the Atm. You need to be able to utilize the Fruit Purse anywhere contactless money is approved. The same thing goes for Google Wallet for as long as your tool try an android os and contains NFC potential. If you’d like to earn much more than simply step one% by paying their portable costs with a charge card, your best bet is amongst the notes a lot more than. However, this isn’t really the only reason to expend your statement that have credit cards.

To begin with, to find the fresh handbag application on the smartphone—some are currently hung—next enter into their borrowing otherwise debit cards information. The applying makes you store several notes and also to place your own default commission means. Your Electronic Wallet can be’t be used to have an installment instead your own verification. It consolidation produces cellular money probably the most easier way to shell out.